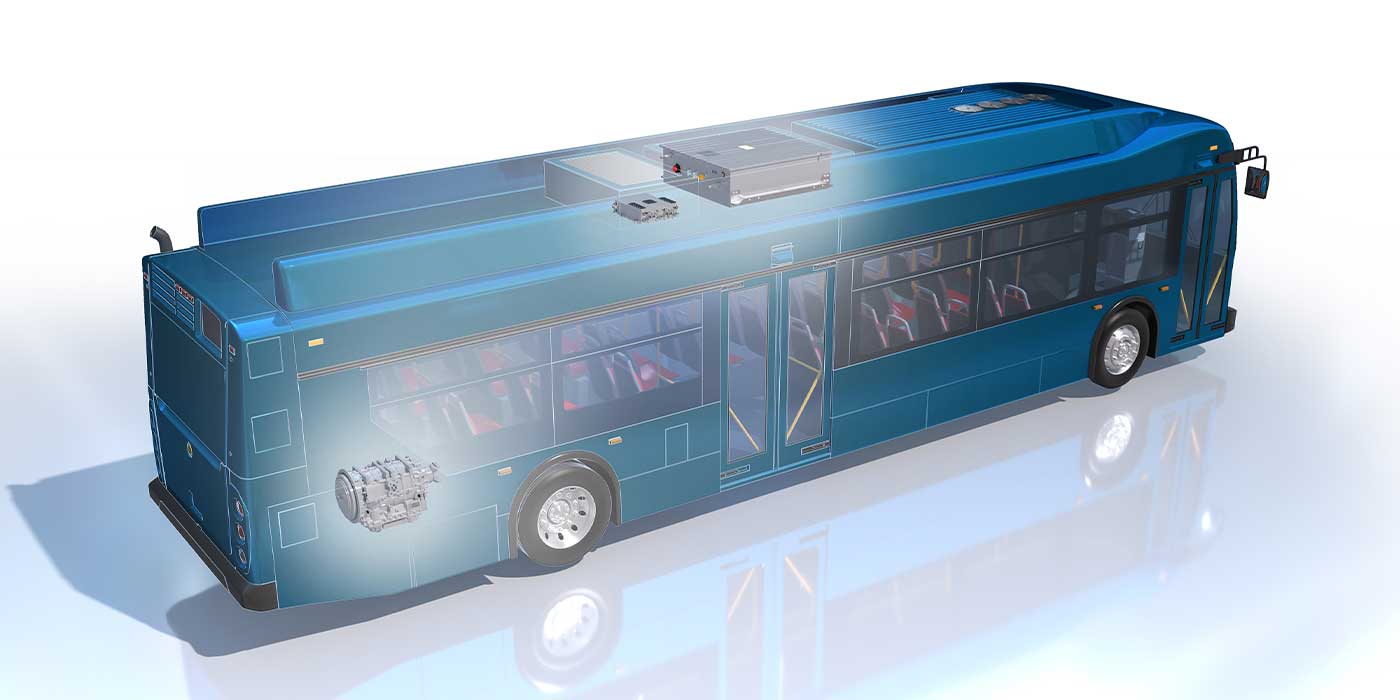

You can’t turn a corner these days without seeing a headline about electric vehicles. In recent years, this caused some consternation in the automotive aftermarket, with internal combustion engine (ICE) vehicles being the bread and butter for this industry. However, new data shows there will continue to be room for – and a need for – products for both incoming electric and ICE vehicles.

According to data from the Joint EV Trends and Outlook Forecast from MEMA and Auto Care Association, while EVs are beginning to penetrate the U.S. car parc, ICE vehicles will maintain the majority share through 2040. By 2030, the average estimate for approximately 30% of new car sales will be electric vehicles, according to PwC, which partnered with the associations on the joint forecast.

That being said, over the past several months, we have seen a significant uptick in industry activation surrounding vehicle electrification, in a variety of ways.

Within the automotive aftermarket, we are beginning to see a mindset shift, moving from skepticism surrounding the idea of EVs into more companies seeing the opportunities available in this rapidly growing space. Take for example longtime diagnostic products provider Autel entering the market this past June with the launch of its new Autel Energy division, which released the MaxiCharger Home and Commercial Level 2 AC chargers, available in 40-amp and 50-amp flexible charging configurations, compatible with all plug-in electric vehicles.

In the automotive repair equipment space, BendPak recently introduced its EV2400SL EV battery pack and powertrain lifting system. This push-around full-rise scissor lift table is designed to make replacing both electric vehicle battery packs and internal combustion powertrain components more efficient, the company said. The patent-pending design offers all the benefits of BendPak’s former SL24EVT lifting system with several user-friendly enhancements.

Just this past month, GM announced plans to invest a total of $20.5 million across three of its Customer Care and Aftersales parts distribution centers in Tennessee and Michigan to modernize warehouse operations as the automaker prepares for industry growth and electric vehicle readiness.

NAPA also saw the need to invest in preparation for the incoming change and this past fall announced its “NexDrivePowered by NAPA” training program in the U.S. to prepare repair shops for the changes electrification brings in the repair segment.

In January, Shell paid a cool $169 million to acquire EV charging company Volta to “unlock long-term growth opportunities in electric vehicle charging,” the company stated.

Bridgestone unveiled at CES this January it’s new Smart Corner solution, a demonstration of the ability to enhance the performance, comfort and efficiency of electric and autonomous vehicles, while maximizing the lifespan of tires and air springs. The solution combines premium Bridgestone tires and Firestone Airide (previously Firestone Industrial Products) air springs that are engineered specifically for electric and autonomous vehicle applications.

Standard Motor Products said it is committed to providing replacement parts for hybrids and EVs and has added new part numbers specifically for hybrids and EVs through its Standard and Four Seasons brands.

Valvoline this past year announced not only a line. of automotive fluids specifically for use in Hybrid and Plug-in EVs but also EV service offerings in the U.S.

These are just a handful of examples of businesses that have long been involved in the traditional ICE market segment creating opportunities in the EV market, as well.

From a consumer standpoint, the rate adoption of EVs varies from country to country, with cost (be it cost-savings or cost barriers) being one of the top factors.

According to ShopOwner’s sister publication dedicated to EVs, The Buzz, “While internal combustion engine (ICE) vehicles still dominate future vehicle purchase intentions, preference for electrified powertrains continues to rise. Overall, the global shift to EVs is occurring at different speeds as individual markets face varying challenges to adoption, including cost and availability of charging infrastructures.”

Citing data from Deloitte’s 2023 Global Automotive Consumer Study, The Buzz noted that “Despite mounting concerns about climate change and reducing emissions, lower fuel expenses are the top reason consumers choose EVs in the U.S., Germany, India, Japan, the Republic of Korea and Southeast Asia, in an effort to reduce vehicle operating costs.”

In the U.S., intent to purchase hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV) and all-battery powered electric vehicles (BEV) are each up by 3 percentage points from 2022. Globally, consumer interest in BEVs is highest in China (27%, up 10 points year-over-year).